Chapter 1The Information System: An Accountant’s Perspective

Objectives for Chapter 1Recognize the primary information flows within the business environment.

Understand the difference between accounting information systems and management information systems.

Understand the difference between financial transactions and non-financial transactions.

Know the principal features of the general model for information systems.

Understand the organizational structure and functional areas of a business.

Be able to distinguish between external auditing, internal auditing, and advisory services as they related to accounting information systems.

2

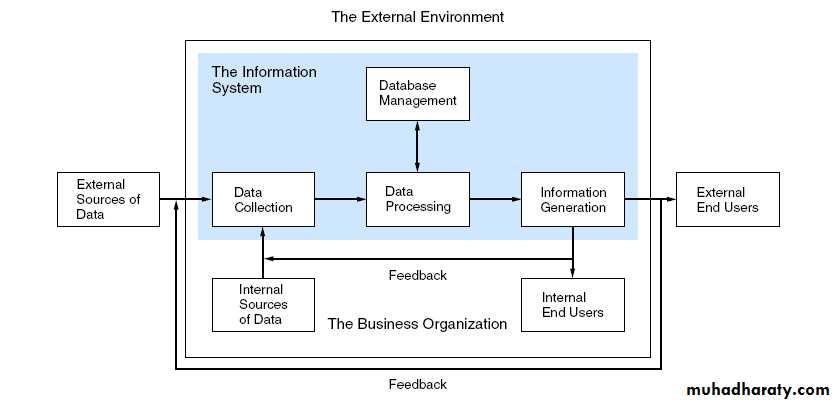

Internal & External Information Flows

3Internal Information Flows

Horizontal flows of information used primarily at the operations level to capture transaction and operations dataVertical flows of information

downward flows — instructions, quotas, and budgets

upward flows — aggregated transaction and operations data

4

Information Objectives

The goal of an information system is to support

To support the stewardship function of management,

To support management decision making, and

To support the firm’s day-to-day operations.

5

What is an Information System?

An information system is the set of formal procedures by which data are collected, processed into information, and distributed to users.6

Transactions

A transaction is a event that affects or is of interest to the organization and is processed by its information system as a unit of work.Financial transactions

economic events that affect the assets and equities of the organization

e.g., purchase of an airline ticket

Nonfinancial transactions

all other events processed by the organization’s information system

e.g., an airline reservation — no commitment by the customer

7

Transactions

8

Financial

Transactions

Nonfinancial

Transactions

Information

System

User

Decisions

Information

What is an Accounting Information System?Accounting is an information system.

It identifies, collects, processes, and communicates economic information about a firm using a wide variety of technologies.

It captures and records the financial effects of the firm’s transactions.

It distributes transaction information to operations personnel to coordinate many key tasks.

9

AIS versus MIS

Accounting Information Systems (AIS) process

financial transactions; e.g., sale of goods

nonfinancial transactions that directly affect the processing of financial transactions; e.g., addition of newly approved vendors

Management Information Systems (MIS) process

nonfinancial transactions that are not normally processed by traditional AIS; e.g., tracking customer complaints

10

AIS versus MIS?

11AIS Subsystems

Transaction processing system (TPS)supports daily business operations

General Ledger/ Financial Reporting System (GL/FRS)

produces financial statements and reports

Management Reporting System (MRS)

produces special-purpose reports for internal use

12

13

Figure 1-5

General Model for AIS

Data Sources

Data sources are financial transactions that enter the information system from internal and external sources.External financial transactions are the most common source of data for most organizations.

E.g., sale of goods and services, purchase of inventory, receipt of cash, and disbursement of cash (including payroll)

Internal financial transactions involve the exchange or movement of resources within the organization.

E.g., movement of raw materials into work-in-process (WIP), application of labor and overhead to WIP, transfer of WIP into finished goods inventory, and depreciation of equipment

14

Transforming the Data into Information

Functions for transforming data into information according to the general AIS model:1. Data Collection

2. Data Processing

3. Data Management

4. Information Generation

15

1. Data Collection

Capturing transaction data

Recording data onto forms

Validating and editing the data

16

2. Data Processing

ClassifyingTranscribing

Sorting

Batching

17

• Merging

• Calculating

• Summarizing

• Comparing

3. Data Management

StoringRetrieving

Deleting

18

4. Information Generation

Compiling

Arranging

Formatting

Presenting

19

Characteristics of Useful Information

Regardless of physical form or technology, useful information has the following characteristics:Relevance: serves a purpose

Timeliness: no older than the time period of the action it supports

Accuracy: free from material errors

Completeness: all information essential to a decision or task is present

Summarization: aggregated in accordance with the user’s needs

20

Organizational Structure

The structure of an organization helps to allocateresponsibility

authority

accountability

Segmenting by business function is a very common method of organizing.

21

Functional Segmentation

Materials Management

purchasing, receiving and stores

Production

production planning, quality control, and maintenance

Marketing

Distribution

Personnel

Finance

Accounting

Information Technology

22

Accounting Independence

Information reliability requires accounting independence.Accounting activities must be separate and independent of the functional areas maintaining resources.

Accounting supports these functions with information but does not actively participate.

Decisions makers in these functions require that such vital information be supplied by an independent source to ensure its integrity.

23

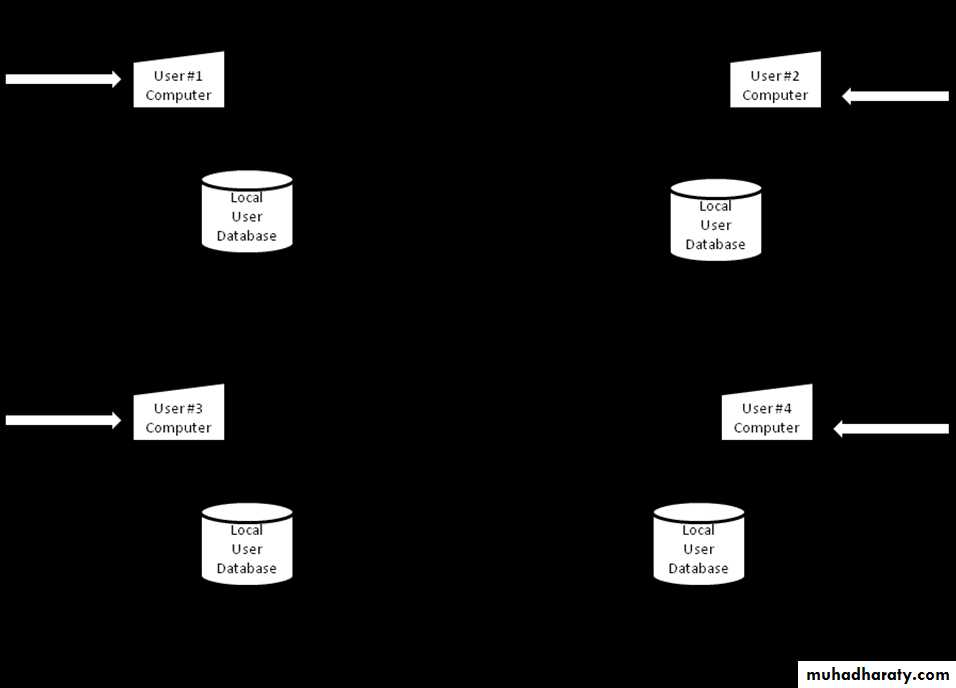

IT: Data Processing

24Centralized Data

Processing

Distributed Data

Processing

Most companies fall in between.

All data processing

is performed by

one or more large

computers housed

at a central site

that serves users

throughout the

organization.

Primary areas:

database administration

data processing

systems development

systems maintenance

Reorganizing the

computer services

function into small

information processing

units that are distributed

to end users and

placed under their control

Distributed Data Processing Model

Accountants’ Unique Roles in AIS

Accountants must be able to clearly convey their needs to the systems professionals who design the system.The accountant should actively participate in systems development projects to ensure appropriate systems design.

26

Accountants as System Designers

Accountants are the domain experts and responsible for the conceptual design of the AIS.

Conceptual system design involves specifying the criteria for identifying delinquent customers and the information that needs to be reported.

As the domain expert, the accountant determines the nature of the information required, its sources, its destination, and the accounting rules that need to be applied.

27

Accountants as System Auditors

External (Financial) AuditsInternal Audit

Fraud Audit

28

External (Financial) Audit

Independent attestation regarding the fairness of the presentation of financial statementsTwo types of evidence

Tests of controls

Substantive tests

29

Attest Service versus Advisory Services

SOX restricts non-audit services to clients. Auditor may not provide:bookkeeping or other services related to the accounting records or financial statements of the audit client

financial information systems design and implementation

appraisal or valuation services, fairness opinions, or contribution-in-kind reports

actuarial services

internal audit outsourcing services

management functions or human resources

broker or dealer, investment adviser, or investment banking services

legal services and expert services unrelated to the audit

any other service that the Board determines, by regulation, is impermissible.

30

Internal Audit

an independent appraisal function established within an organization to examine and evaluate its activities as a service to the organization.

Different constituencies from external audit

31

Fraud Audit

investigate anomalies and gather evidence of fraud that may lead to criminal conviction.Initiated

When corporate management suspects employee fraud.

Or, boards of directors hire fraud auditors to investigate their own suspected executives

32

The Role of the Audit Committee

A subcommittee of the Board of Directors that has special responsibilities regarding audits.an independent “check and balance” for the internal audit function and liaison with external auditors

Usually three people (outsiders)

SOX requires one to be a “financial expert”

33